The Company intends to capitalize upon the increasing worldwide demand for high-grade graphite in a cost-effective and potentially profitable fashion, overseen by a highly experienced management team:

| |

Ø

|

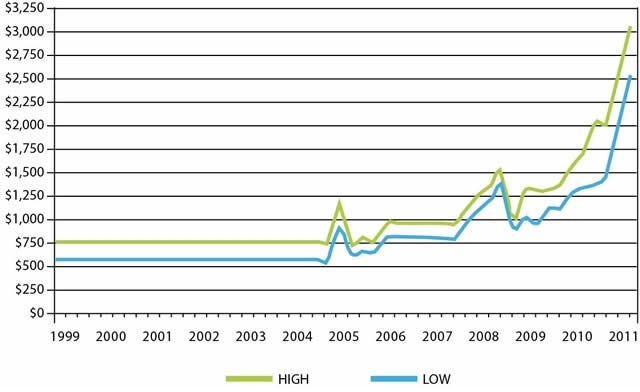

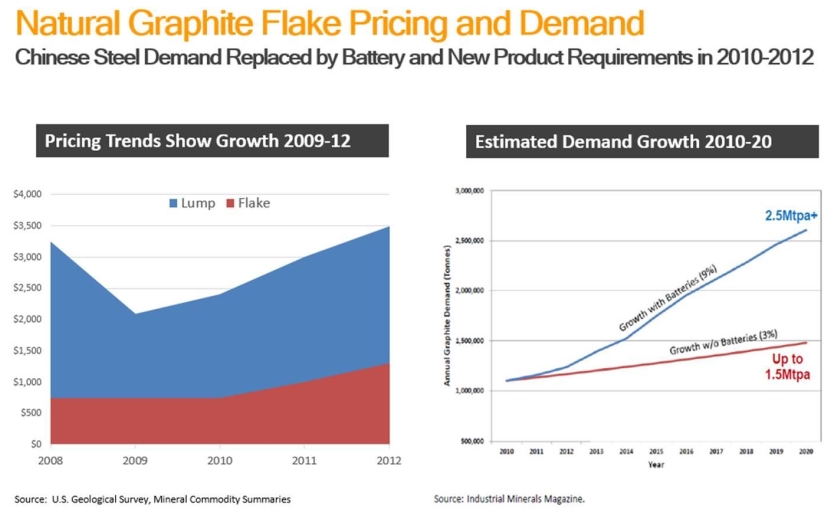

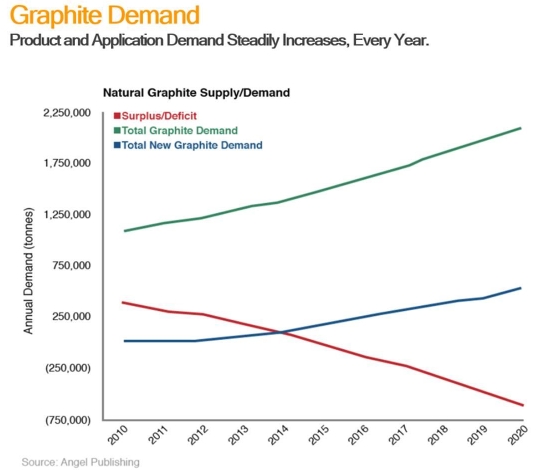

The Global Graphite market, currently estimated at $12 billion, is expected to grow at a Compound Aggregate Growth Rate (“CAGR”) of 5.5% during 2012-2016. One key factor is the increasing use of graphite in batteries, e.g., the Li-Ion market is estimated at ~$250B by 2020 [Source: ReportStack, “Global Graphite Market 2012-2016”].

|

| |

Ø

|

Next Graphite has secured the mining rights to a mine with proven resources that has already been historically operated (has previously produced USD $30 million of graphite at today’s prices, and is estimated by the Company’s geological consultants to contain over 4 million tons of natural, high-grade, large-flake, hydrothermal-sourced graphite reserves)

|

| |

Ø

|

The Company plans to be operating in the Republic of Namibia, a country that is mining-friendly, has infrastructure in place, and has low labor costs.

|

Market, Customers and Distribution Methods

Although there can be no assurance, large and well capitalized markets are readily available for all metals and precious metals throughout the world. A very sophisticated futures market for the pricing and delivery of future production also exists. The price for metals is affected by a number of global factors, including economic strength and resultant demand for metals for production, fluctuating supplies, mining activities and production by others in the industry, and new and or reduced uses for subject metals.

The mining industry is highly speculative and of a very high risk nature. As such, mining activities involve a high degree of risk, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Few mining projects actually become operating mines. The mining industry is subject to a number of factors, including intense industry competition, high susceptibility to economic conditions (such as the price of metal, foreign currency exchange rates, and capital and operating costs), and political conditions (which could affect such things as import and export regulations, foreign ownership restrictions). Furthermore, the mining activities are subject to all hazards incidental to mineral exploration, development and production, as well as risk of damage from earthquakes, any of which could result in work stoppages, damage to or loss of property and equipment and possible environmental damage. Hazards such as unusual or unexpected geological formations and other conditions are also involved in mineral exploration and development.

Our methods of distributing our mined graphite will in part be dictated by what our initial drilling activities indicate relative to quality, quantity, concentration and cost of extraction.

The options we are considering include:

|

·

|

marketing department that sells the Company’s graphite to end users. This will probably not be pursued unless we are mining at least 5,000 - 10,000 tonnes of graphite a year.

|

|

·

|

market the graphite through a partnership with another graphite mine.

|

|

·

|

market the material, via offtakes, to graphite distributors, traders or other companies that may market graphite from more than one mining company.

|

The Company’s costs of operation will also be largely influenced by the factors noted above such as quality, quantity, concentration, and cost of extraction. Based on our initial planned small-scale operation, the cost to build our processing plant will be approximately $1,000,000. We anticipate our on-going costs of operation will be relatively low given our low Namibian labor costs and low extraction costs based on preliminary testing.

Intellectual Property

The Company does not have any Intellectual Property at this time.

Competition

The mineral exploration industry is highly competitive. We are a new exploration stage company and have a weak competitive position in the industry. We compete with junior and senior mineral exploration companies, independent producers and institutional and individual investors who are actively seeking to acquire mineral exploration properties throughout the world together with the equipment, labor and materials required to operate on those properties. Competition for the acquisition of mineral exploration interests is intense with many mineral exploration leases or claims available in a competitive bidding process in which we may lack the technological information or expertise available to other bidders.

Many of the mineral exploration companies with which we compete for financing and for the acquisition of mineral exploration properties have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquiring mineral exploration interests of merit or on exploring or developing their mineral exploration properties. This advantage could enable our competitors to acquire mineral exploration properties of greater quality and interest to prospective investors who may choose to finance their additional exploration and development. Such competition could adversely impact our ability to attain the financing necessary for us to acquire further mineral exploration interests or explore and develop our current or future mineral exploration properties.

We also compete with other junior mineral exploration companies for financing from a limited number of investors that are prepared to invest in such companies. The presence of competing junior mineral exploration companies may impact our ability to raise additional capital in order to fund our acquisition or exploration programs if investors perceive that investments in our competitors are more attractive based on the merit of their mineral exploration properties or the price of the investment opportunity. In addition, we compete with both junior and senior mineral exploration companies for available resources, including, but not limited to, professional geologists, land specialists, engineers, camp staff, helicopters, float planes, mineral exploration supplies and drill rigs.

General competitive conditions may be substantially affected by various forms of energy legislation and/or regulation introduced from time to time by the governments of the United States and other countries, as well as factors beyond our control, including international political conditions, overall levels of supply and demand for mineral exploration. In the face of competition, we may not be successful in acquiring, exploring or developing profitable mineral properties or interests, and we cannot give any assurance that suitable oil and gas properties or interests will be available for our acquisition, exploration or development. Despite this, we hope to compete successfully in the mineral exploration industry by:

|

|

●

|

keeping our costs low;

|

| |

●

|

relying on the strength of our management’s contacts; and

|

| |

●

|

using our size and experience to our advantage by adapting quickly to changing market conditions or responding swiftly to potential opportunities.

|

Government Regulation

In Namibia, all mineral rights are vested in the state. The Minerals (Prospecting and Mining) Act of 1992 regulates the mining industry in the country. The Ministry of Mines and Energy is responsible for mining. Licenses and permits are authorized by the Minister on recommendation of the Mining Commissioner. Namibia's mining industry is also regulated by the Minerals Development Fund of Namibia Act of 1996 and the Diamond Act of 1999. Several types of mining and prospecting licenses exist as follows:

|

·

|

Non-Exclusive Prospecting Licenses, valid for 12 months, permit prospecting non-exclusively in any open group not restricted by other mineral rights.

|

|

·

|

Reconnaissance Licenses allow regional remote sensing techniques, and are valid for 6 months (renewable under special circumstances) and can be made exclusive in some instances.

|

|

·

|

Exclusive Prospecting Licenses can cover areas not exceeding 1000 square kilometers and are valid for 3 years, with two renewals of 2 years each and discretionary renewals thereafter. Two or more EPLs can be issued for more than one mineral in the same area.

|

|

·

|

Mineral Deposit Retention Licenses (MDRLs) allow successful prospectors to retain rights to mineral deposits which are uneconomical to exploit immediately. MDRLs are valid for up to 5 years and can be renewed subject to limited work and expenditure obligations.

|

|

·

|

Mining Licenses can be awarded to Namibian citizens and companies registered in Namibia. They are valid for an initial 25 years, renewable up to 15 years at a time.

|

|

·

|

There is no requirement that the Government should hold equity participation in mining ventures.

|

We will be required to comply with the foregoing government regulations. An Environmental Impact Assessment is currently being prepared, and a Mining License for extraction will be applied for.

Additional approvals and authorizations may be required from other government agencies, depending upon the nature and scope of the proposed exploration program. The amount of these costs is not known as we do not know the size, quality of any resource or reserve at this time. It is impossible to assess the impact of any capital expenditures on earnings or our competitive position.

Environmental Regulations

Our exploration activities are also subject to laws and regulations of Namibia governing protection of the environment. These laws are continually changing and, as a general matter, are becoming more restrictive. Our policy is to conduct business in a way that safeguards public health and the environment and in material compliance with applicable environmental laws and regulations. Changes to current laws and regulations in the jurisdictions where we operate could require additional capital expenditures and increased operating costs. Although we are unable to predict what additional legislation and the associated costs of such legislation, if any, might be proposed or enacted, additional regulatory requirements could render certain exploration activities uneconomic.

Employees

As of March 31, 2014, the Company and its subsidiaries had no employees. The Company utilizes the services of consultants and advisors. These include its principal executive officer, chief financial officer, geological personnel, accountants, and attorneys. Some of these positions, especially those of a technical nature, may be converted to employment if and when the Company's business requires and resources permit.

Emerging Growth Company

The Company is an “emerging growth company”, as defined in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”), and may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of section 404(b) of the Sarbanes-Oxley Act, and exemptions from the requirements of Sections 14A(a) and (b) of the Securities Exchange Act of 1934 to hold a nonbinding advisory vote of shareholders on executive compensation and any golden parachute payments not previously approved.

The Company has elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act. This election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

We will remain an “emerging growth company” until the earliest of (1) the last day of the fiscal year during which our revenues exceed $1 billion, (2) the date on which we issue more than $1 billion in non-convertible debt in a three year period, (3) the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement filed pursuant to the Securities Act of 1933, as amended, or (4) when the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter.

To the extent that we continue to qualify as a “smaller reporting company”, as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, after we cease to qualify as an emerging growth company, certain of the exemptions available to us as an emerging growth company may continue to be available to us as a smaller reporting company, including: (1) not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes Oxley Act; (2) scaled executive compensation disclosures; and (3) the requirement to provide only two years of audited financial statements, instead of three years.

ITEM 1A. RISK FACTORS

An investment in the Company is subject to risks and uncertainties. The occurrence of any one or more of these risks or uncertainties could have a material adverse effect on the value of any investment in the Company and the business, prospects, financial position, financial condition or operating results of the Company. Prospective investors should carefully consider the information presented in this report, including the following risk factors, which are not an exhaustive list of all risk factors associated with an investment in the Company or the Company’s shares or in connection with the operations of the Company:

The Company has a limited history of operations and Aukum Graphite Project is the Company’s sole asset. There can be no assurance that any of the Company’s planned exploration and development activities on the Aukum Graphite Project will ever lead to the re-launch of graphite production from it.

The Company has a limited history of operations and is in the early stage of development. The Company is engaged in the business of exploring, resuming production and developing a single asset, the Aukum Graphite Project, in the hope of ultimately, at some future point, placing the Aukum Graphite Project back into production. The Aukum Graphite Project will be for the foreseeable future the Company’s sole asset. Although management believes the Aukum Graphite Project has sufficient merit to justify focusing all the Company’s limited resources upon it, the Company will in consequence be exposed to some heightened degree of risk due to the lack of property diversification. The Aukum Graphite Project is assumed to still host graphitic material that has been historically mined. However, there are no guarantees that the re-launched production of these potentially indicated and inferred resources will ever be demonstrated, in whole or in part, to be profitable to mine. Development of the Aukum Graphite Project will only follow upon obtaining satisfactory results from the recommended multi-phase testing, exploration and development program and any subsequent work and studies that may be required. There can be no assurance that any of the Company’s planned exploration and development activities on the Aukum Graphite Project will ever lead to the re-launch of graphite production from it.

There is no guarantee that the mineral deposit contained in the Aukum Graphite Project will be commercially viable.

The exploration and development of mineral projects is highly speculative in nature and involves a high degree of financial and other risks over a significant period of time, which even a combination of careful evaluation, experience and knowledge may not reduce or eliminate. The Aukum Graphite Project will constitute the Company’s sole asset. However, there are no guarantees that there will ever be a profitable mining operation on the Aukum Graphite Project. The proposed multi-phase exploration and development program on the Aukum Graphite Project is subject to a significant degree of risk. Whether a mineral deposit will be commercially viable depends on a number of factors, including the particular attributes of the deposit (i.e. size, grade, access, flake size distribution, contaminants, and proximity to infrastructure), financing costs, the cyclical nature of commodity prices and government regulations (including those relating to prices, taxes, currency controls, royalties (both product and monetary), land tenure, land use, importing and exporting of mineral products, and environmental protection). The effect of these factors or a combination thereof cannot be accurately predicted but could have an adverse impact on the Company.

The Company has no history of mineral production.

Even though the Aukam Graphite Project has produced graphite historically, the Company has never had an interest in a mineral-producing property. There is no assurance that commercial quantities of minerals will be discovered at any future properties, nor is there any assurance that any future exploration programs of the Company on the Aukum Graphite Project or any future properties will yield any positive results. Even where commercial properties of minerals are discovered, there can be no assurance that any property of the Company will ever be brought to a stage where mineral reserves can be profitably produced thereon. Factors that may limit the ability of the Company to produce mineral resources from its property include, but are not limited to, the price of mineral resources are explored, availability of additional capital and financing and the nature of any mineral deposits.

The Company’s operations will be subject to all of the hazards and risks normally encountered in mineral exploration and development. The Company does not currently carry insurance against these risks and there is no assurance that such insurance will be available in the future, or if available, at economically feasible premiums or acceptable terms.

Mining operations generally involve a high degree of risk. The Company’s operations will be subject to all of the hazards and risks normally encountered in mineral exploration and development. Such risks include unusual and unexpected geological formations, seismic activity, rock bursts, cave-ins, water inflows, fires and other conditions involved in the drilling and removal of material, environmental hazards, industrial accidents, periodic interruptions due to adverse weather conditions, labor disputes, political unrest and theft. The occurrence of any of the foregoing could result in damage to, or destruction of, mineral properties or interests, production facilities, personal injury, damage to life or property, environmental damage, delays or interruption of operations, increases in costs, monetary losses, legal liability and adverse government action. The Company does not currently carry insurance against these risks and there is no assurance that such insurance will be available in the future, or if available, at economically feasible premiums or acceptable terms. The potential costs associated with losses or liabilities not covered by insurance coverage may have a material adverse effect upon the Company’s financial condition.

The Company has a limited operating history and financial resources.

The Company has a limited operating history, has no operating revenues and is unlikely to generate any revenues from operations in the immediate future. Its existing cash resources are not sufficient to cover its projected funding requirements for the ensuing year. If its phased exploration and development program is successful, additional funds will be required to bring the Aukum Graphite Project back into production. The Company has limited financial resources and there is no assurance that sufficient additional funding will be available to enable it to fulfill its obligations or for further exploration and development on acceptable terms or at all. Failure to obtain additional funding on a timely basis could result in delay or indefinite postponement of further exploration and development and could cause the Company to reduce or terminate its operations.

If we cease to continue as a going concern, due to lack of funding or otherwise, you may lose your entire investment in the Company.

Our current plans indicate that we will need substantial additional capital to implement our plan of operations before we have any anticipated revenues. When we require additional funds, general market conditions or the then-current market price of our common stock may not support capital raising transactions such as additional public or private offerings of our common stock. If we require additional funds and we are unable to obtain them on a timely basis or on terms favorable to us, we may be required to scale back our development of new products, sell or license some or all of our technology or assets, or curtail or cease operations.

The Company is subject to Namibian government regulation of its mining operations. Although the Company believes that the Aukum Graphite Project is in substantial compliance with all material laws and regulations that currently apply to its activities, there can be no assurance, however, that the Company will obtain on reasonable terms or at all the permits and approvals, and the renewals thereof, which it may require for the conduct of its future operations or that compliance with applicable laws, regulations, permits and approvals will not have an adverse effect on plans to explore and develop the Aukum Graphite Project.

The future operations of the Company, including exploration and development activities and the commencement and continuation of commercial production, require licenses, permits or other approvals from various federal, provincial and local governmental authorities and such operations are or will be governed by laws and regulations relating to prospecting, development, mining, production, exports, taxes, labor standards, occupational health and safety, waste disposal, toxic substances, land use, water use, environmental protection, land claims of indigenous people and other matters. The Company believes that the Aukum Graphite Project is in substantial compliance with all material laws and regulations that currently apply to its activities. There can be no assurance, however, that the Company will obtain on reasonable terms or at all the permits and approvals, and the renewals thereof, which it may require for the conduct of its future operations or that compliance with applicable laws, regulations, permits and approvals will not have an adverse effect on plans to explore and develop the Aukum Graphite Project. Possible future environmental and mineral tax legislation, regulations and actions could cause additional expense, capital expenditures, restrictions and delay on the Company’s planned exploration and operations, the extent of which cannot be predicted.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

The initial property report was based on production data generated from the Namibian Ministry of Mines and Energy and from prior exploration work. There is no guarantee in reliability of such data.

In preparing the initial property report, The Aukum property Geological Report of February 16, 2014, the authors of that report from Element 12 Consulting relied upon certain data generated on production from the government-mining ministry, and by exploration work carried out by geologists employed by others. There is no guarantee that data generated from government records or by prior exploration work is 100% reliable and discrepancies in such data not discovered by the Company may exist. Such errors and/or discrepancies, if they exist, could have impact on the accuracy of the subject report.

If we lose the services of key management personnel and are unable to attract and retain highly skilled employees, we may not be able to execute our business strategy effectively.

The success of the Company will be largely dependent upon the performance of its senior management and directors. Due to the relative small size of the Company, the loss of these persons or the inability of the Company to attract and retain additional highly skilled employees may adversely affect its business and future operations. The Company has not purchased any “key-man” insurance nor has it entered into any non-competition or non-disclosure agreements with any of its directors, officers or key employees and has no current plans to do so.

While our executive officers and directors are highly experienced in business, they do not come from the mining industry and rely on Company managers and consultants for specific mining expertise. The Company has hired and may continue to rely upon consultants and others for geological and technical expertise. The Company’s current personnel may not include persons with sufficient technical expertise to carry out the future development of the Company’s properties. There is no assurance that suitably qualified personnel can be retained or will be hired for such development.

The Company faces increased competition for equipment and experienced personnel from competitors with greater financial and technical resources.

The mineral exploration and mining business is competitive in all of its phases. The mining industry is facing a shortage of equipment and skilled personnel and there is intense competition for experienced geologists, field personnel, contractors and management, including from competitors with greater financial resources. There is no assurance that the Company will be able to compete successfully with others in acquiring such equipment or personnel.

There is no guarantee that the Company will be successful in its competition for productive mineral properties and financing with competitors possessing greater financial and technological resources.

The mineral exploration and mining business is competitive in all phases of exploration, development and production. The Company competes with a number of other entities in the search for and acquisition of productive mineral properties. As a result of this competition, the majority of which is with companies with greater financial resources than the Company, the Company may be unable to acquire attractive properties in the future on terms it considers acceptable. The Company also competes for financing with other resources companies, many of whom have greater financial resources and/or more advanced properties. There can be no assurance that additional capital or other types of financing will be available if needed or that, if available, the terms of such financing will be favorable to the Company.

There is no assurance that the Company will be able to obtain a leasehold interest to the land lot covering the Aukum Graphite Project on financially sound terms.

The land lot comprising the Aukum Graphite Project is owned by an unrelated third party, and the Company will need to obtain a leasehold interest to such land lot before it can commence mining operations. Under the laws of Namibia, the grant of a mining license guarantees access to the land where a mineral deposit is located. The financial terms of such access, however, need to be negotiated directly with the land owner. While the Company believes that it will be able to negotiate financially sound terms of such access when mining is commenced, there can be no assurance or guarantee that such terms will be acceptable to the Company.

There can be no assurance that the Company will be able to secure the renewal of the prospecting license or grant of a mining license on terms satisfactory to it, or that governments having jurisdiction over the Aukum Graphite Project will not revoke or significantly alter such license or other tenures or that such license and tenures will not be challenged or impugned.

The Company possesses the license to the Aukum Graphite Project allowing for prospecting operations, bulk sampling and pilot production (subject to ministry approval) in the license area, which expires on April 3, 2015. The exploration license that expires April 3, 2015, will be followed by a mining license, which cost is dependent on a number of variables that the Namibian Ministry of Mines will determine. We do not expect that the mining license will exceed $20,000 in annual cost. While the Namibian government has an interest in the license area being developed and the Company believes that it will be able to obtain necessary extensions on the prospecting license and grant of a mining license required to recommence mining operations, there can be no assurance that the Company will be able to secure the renewal of the prospecting license or grant of a mining license on terms satisfactory to it, or that governments having jurisdiction over the Aukum Graphite Project will not revoke or significantly alter such license or other tenures or that such license and tenures will not be challenged or impugned.

If environmental hazards are identified on the Aukum Graphite Project,it may have the potential to negatively impact on the Company’s exploration and development plans for the Aukum Graphite Project.

All phases of the Company’s operations will be subject to environmental regulation in the jurisdictions in which it operates. These regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation and provide for restrictions and prohibitions on spills, releases or emissions of various substances produced in association with certain mining industry activities and operations. They also set forth limitations on the generation, transportation, storage and disposal of hazardous waste. A breach of such regulation may result in the imposition of fines and penalties. In addition, certain types of mining operations require the submission and approval of environmental impact assessments. Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. The cost of compliance with changes in governmental regulations has the potential to reduce the viability or profitability of operations of the Company. The Aukum Graphite Project has in the past been subject to an environmental study. Additional environmental studies will, however, be required as the Company’s anticipated exploration and development programs unfold. It is always possible that, as work proceeds, environmental hazards may be identified on the Aukum Graphite Project which are at present unknown to the Company and which may have the potential to negatively impact on the Company’s exploration and development plans for the Aukum Graphite Project.

The price of the Company’s securities, its financial results and its exploration, development and mining activities may be significantly adversely affected by declines in the price of graphite.

The price of the Company’s securities, its financial results and its exploration, development and mining activities may be significantly adversely affected by declines in the price of graphite. Industrial mineral prices fluctuate widely and are affected by numerous factors beyond the Company’s control such as the sale or purchase of industrial minerals by various dealers, interest rates, exchange rates, inflation or deflation, currency exchange fluctuation, global and regional supply and demand, production and consumption patterns, speculative activities, increased production due to improved mining and production methods, government regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals, environmental protection, the degree to which a dominant producer uses its market strength to bring supply into equilibrium with demand, and international political and economic trends, conditions and events. The prices of industrial minerals have fluctuated widely in recent years, and future price declines could cause continued exploration and development of the Aukum Graphite Project to be impracticable. Further, reserve calculations and life-of-mine plans using significantly lower industrial mineral prices could result in material write-downs of the Company’s investment in the Aukum Graphite Project and increased amortization, reclamation and closure charges. In addition to adversely affecting reserve estimates and the Company’s financial condition, declining commodity prices can impact operations by requiring a reassessment of the feasibility of a particular project. Such a reassessment may be the result of a management decision or may be required under financing arrangements related to a particular project. Even if the project is ultimately determined to be economically viable, the need to conduct such a reassessment may cause substantial delays or may interrupt operations until the reassessment can be completed.

As our business grows, we will need to hire highly skilled personnel and, if we are unable to retain or motivate hire additional qualified personnel, we may not be able to grow effectively.

Although no assurance can be given, the Company contemplates that growth will occur as the Company implements its business strategies. The Company expects the expansion of its business to place a significant strain on its limited managerial, operational, and financial resources. The Company will be required to expand its operational and financial systems significantly and to expand, train, and manage its work force in order to manage the expansion of its operations. The Company’s failure to fully integrate new employees into its operations could have a material adverse effect on its business, prospects, financial condition, and results of operations. The Company’s ability to attract and retain highly skilled personnel in connection with its growth is critical to its operations and expansion. The Company faces competition for these types of personnel from other mining companies and more established organizations, many of which have significantly larger operations and greater financial, marketing, human, and other resources than does the Company. The Company may not be successful in attracting and retaining qualified personnel on a timely basis, on competitive terms, or at all. If the Company is not successful in attracting and retaining these personnel, its business, prospects, financial condition, and results of operations will be materially adversely affected.

There is currently no active public market for the Company's common stock and the market price of the common stock may fluctuate significantly.

There has been no active public market for the Company common stock. An active public market for the Company's common stock may not develop or be sustained. The market price of the common stock may fluctuate significantly in response to factors, some of which are beyond the Company's control, such as product liability claims or other litigation, the announcement of new pharmaceuticals or pharmaceutical enhancements by the Company’s competitors, developments concerning intellectual property rights and regulatory approvals, quarterly variations in competitors' results of operations, changes in earnings estimates or recommendations by securities analysts, developments in our industry, and general market conditions and other factors, including factors unrelated to our operating performance.

Issuance of additional shares of common stock or securities convertible into common stock may substantially dilute the ownership interests of our existing stockholders.

We may in the future issue our previously authorized and unissued securities, resulting in the dilution of the ownership interests of our common stockholders. We are currently authorized to issue one hundred million shares of common stock and ten million shares of preferred stock with such designations, preferences and rights as determined by our board of directors. Issuance of additional shares of common stock may substantially dilute the ownership interests of our existing stockholders. We may also issue additional shares of our common stock or other securities that are convertible into or exercisable for common stock in connection with the hiring of personnel, future acquisitions, future public or private placements of our securities for capital raising purposes, or for other business purposes. Any such issuance would further dilute the interests of our existing stockholders.

The outcomes of any legal action may have a material adverse effect on the financial results of the Company.

From time to time, the Company may be involved in lawsuits. The outcomes of any such legal actions may have a material adverse effect on the financial results of the Company on an individual or aggregate basis.

The Company does not anticipate paying any dividends on its common stock.

The Company has no earnings or dividend record and does not anticipate paying any dividends on its common shares in the foreseeable future.

Our common stock is considered “a penny stock” and, as a result, it may affect the ability of investors to sell their shares.

The SEC has adopted regulations which generally define "penny stock" to be an equity security that has a market or exercise price of less than $5.00 per share, subject to specific exemptions. The market price of the Company’s common stock may be below $5.00 per share and therefore may be designated as a "penny stock" according to SEC rules. This designation requires any broker or dealer selling these securities to disclose certain information concerning the transaction, obtain a written agreement from the purchaser and determine that the purchaser is reasonably suitable to purchase the securities. These rules may restrict the ability of brokers or dealers to sell such shares and may affect the ability of investors to sell their shares. In addition, since the Company’s common stock is currently quoted on the OTC Bulletin Board, investors may find it difficult to obtain accurate quotations of the stock and may find few buyers to purchase the stock or a lack of market makers to support the stock price.

Failure to achieve and maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act of 2002 could prevent the Company from producing reliable financial reports or identifying fraud. In addition, current and potential stockholders could lose confidence in the Company's financial reporting, which could have an adverse effect on the Company's stock price.

Effective internal controls are necessary for the Company to provide reliable financial reports and effectively prevent fraud, and a lack of effective controls could preclude the Company from accomplishing these critical functions. We are required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), which requires annual management assessments of the effectiveness of the Company's internal controls over financial reporting.

If we fail to maintain the adequacy of our internal accounting controls, as such standards are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404. Failure to achieve and maintain an effective internal control environment could cause investors to lose confidence in our reported financial information, which could have an adverse effect on our stock price.

Under the JOBS Act we have elected to use an extended period for complying with new or revised accounting standards.

We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1), which allows us to delay adoption of new or revised accounting standards that have different effective dates for public and private until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

ITEM 2. PROPERTIES

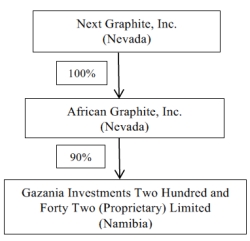

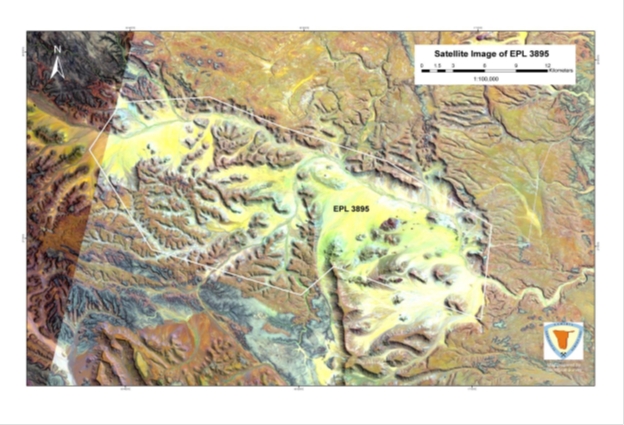

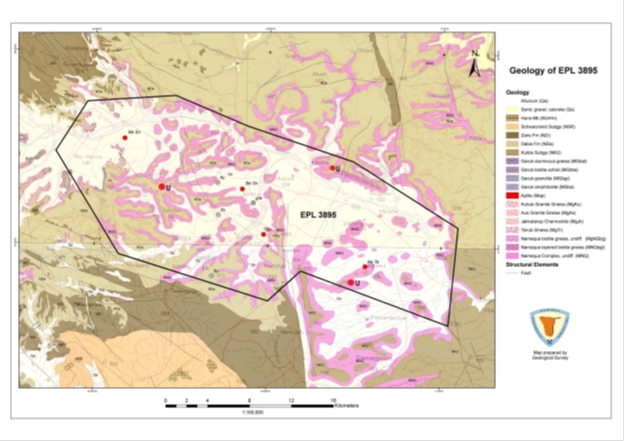

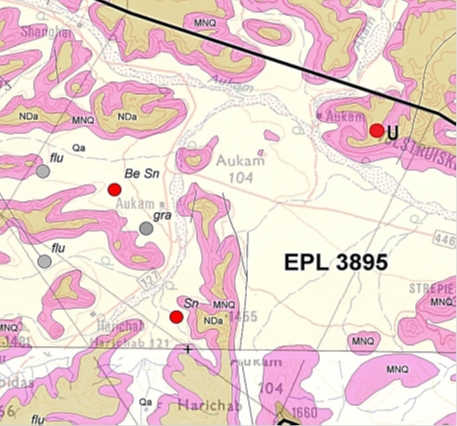

The Company’s direct 90% owned subsidiary Gazania owns a 100% undivided interest in the exclusive prospecting license No. 3895 known as AUKUM originally issued to Centre by the government of the Republic of Namibia on April 4, 2011 and renewed on April 4, 2013 (the “License”). The License grants the right to conduct prospecting operations, bulk sampling and pilot production in the license area called AUKAM located in southern Namibia in the Karas Region within the Betaine district. The license area covers about 49,127 hectares.

The property is named after the Aukam Farm where it is located. A surface royalty will have to be discussed with the farm owner when mining recommences on the property. Under the laws of Namibia, the grant of a mining license guarantees access to the land where a mineral deposit is located. The financial terms of such access, however, need to be negotiated directly with the land owner. The Company believes that it will be able to negotiate financially sound terms of such access when mining is recommenced.

ITEM 3. LEGAL PROCEEDINGS

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings or claims that we believe will have a material adverse effect on our business, financial condition or operating results.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our Common Stock, $.0001 par value, is quoted on the OTC Bulletin Board under the symbol “GPNE.” There were no reported quotations for our common stock during the fiscal years 2013 and 2012.

As of March 31, 2014, we had approximately 52 shareholders of record. The holders of common stock are entitled to one vote for each share held of record on all matters submitted to a vote of stockholders. Holders of the common stock have no preemptive rights and no right to convert their common stock into any other securities. There are no redemption or sinking fund provisions applicable to the common stock

Dividends

Since our inception, we have not declared nor paid any cash dividends on our capital stock and we do not anticipate paying any cash dividends in the foreseeable future. Our current policy is to retain any earnings in order to finance our operations. Our Board of Directors will determine future declarations and payments of dividends, if any, in light of the then-current conditions it deems relevant and in accordance with applicable corporate law.

Securities Authorized for Issuance under Equity Compensation Plans

We have no existing equity compensation plan.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

SPECIAL NOTE OF CAUTION REGARDING FORWARD-LOOKING STATEMENTS

CERTAIN STATEMENTS IN THIS REPORT, INCLUDING STATEMENTS IN THE FOLLOWING DISCUSSION, ARE WHAT ARE KNOWN AS "FORWARD-LOOKING STATEMENTS", WHICH ARE BASICALLY STATEMENTS ABOUT THE FUTURE. FOR THAT REASON, THESE STATEMENTS INVOLVE RISK AND UNCERTAINTY SINCE NO ONE CAN ACCURATELY PREDICT THE FUTURE. WORDS SUCH AS "PLANS", "INTENDS", "WILL", "HOPES", "SEEKS", "ANTICIPATES", "EXPECTS "AND THE LIKE OFTEN IDENTIFY SUCH FORWARD-LOOKING STATEMENTS, BUT ARE NOT THE ONLY INDICATION THAT A STATEMENT IS A FORWARD-LOOKING STATEMENT. SUCH FORWARD-LOOKING STATEMENTS INCLUDE STATEMENTS CONCERNING OUR PLANS AND OBJECTIVES WITH RESPECT TO THE PRESENT AND FUTURE OPERATIONS OF THE COMPANY, AND STATEMENTS WHICH EXPRESS OR IMPLY THAT SUCH PRESENT AND FUTURE OPERATIONS WILL OR MAY PRODUCE REVENUES, INCOME OR PROFITS. NUMEROUS FACTORS AND FUTURE EVENTS COULD CAUSE THE COMPANY TO CHANGE SUCH PLANS AND OBJECTIVES OR FAIL TO SUCCESSFULLY IMPLEMENT SUCH PLANS OR ACHIEVE SUCH OBJECTIVES, OR CAUSE SUCH PRESENT AND FUTURE OPERATIONS TO FAIL TO PRODUCE REVENUES, INCOME OR PROFITS. THEREFORE, THE READER IS ADVISED THAT THE FOLLOWING DISCUSSION SHOULD BE CONSIDERED IN LIGHT OF THE DISCUSSION OF RISKS AND OTHER FACTORS CONTAINED IN THIS REPORT ON FORM 10-K AND IN THE COMPANY'S OTHER FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION. NO STATEMENTS CONTAINED IN THE FOLLOWING DISCUSSION SHOULD BE CONSTRUED AS A GUARANTEE OR ASSURANCE OF FUTURE PERFORMANCE OR FUTURE RESULTS.

Plan of Operations

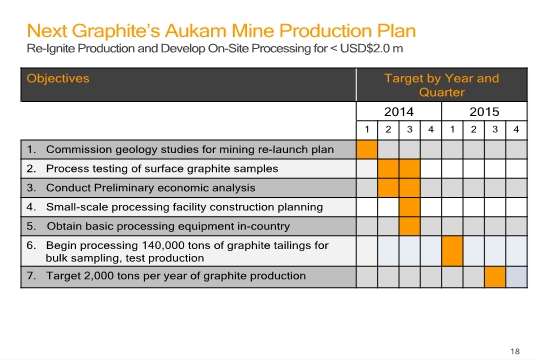

The Company plans to re-launch mining production and on site processing at the Aukum Graphite Mine at an estimated cost of $2,000,000. Approximately $1,000,000 has been targeted for 2013-2014 start-up costs such as mining rights acquisition, licensing, engineering, geological and project consultants fees, accounting and legal fees,. An additional $1,000,000 has been budgeted for the 2015 costs of a small-scale, on-site processing plant.

Targeted 2014 pre-production activities, budgeted at approximately $800,000 have and will include: the transfer of the mining license to Next Graphite Inc.; initial testing of the Aukum Graphite Mine samples and the compilation of its initial geological report; process testing of surface graphite samples from on-site tailings; preparation of an Environmental Impact Assessment report; application for a Mining License for extraction; preliminary drilling and advanced product testing; preliminary economic analysis based on our findings and a scoping study that details the engineering for production, mining design, flowchart and operations; construction planning for a small-scale processing facility; and continuing public company governance, overhead & professional services.

The Company will need to raise the aforementioned $800,000 in funding for planned 2014 activities. Funds will also be required to pursue the exploration of additional subterranean graphite on the property with the goal to produce 2,000 tonnes of graphite yearly.

The completed, re-opened mine will be targeting an estimated 2,000 tons of annual production, with initial production targeted for the first quarter of 2015. As previously stated, approximately $1,000,000 has been targeted for securing basic processing equipment and other costs associated with the construction of a small-scale, on-site processing plant. We believe the Company should be profitable within 18 months of initial production.

The management team continues to review and assess the benefits and costs to of financing structures and methods to fund its growth. While the Company believes it will begin to realize some revenue and working capital in 2015 through initial sales of graphite, it plans to obtain most of its required capital through private placements of its common stock to accredited investors .

Results of Operations

We did not have any revenues since inception. We incurred operating expenses of $2,569,223, and realized a net loss of $2,569,223 since inception on August 29, 2013 to December 31, 2013.

Liquidity and Capital Resources

As of December 31, 2013, we had $2,450 in cash.

The Company does not currently have sufficient resources to cover ongoing expenses and expansion. From November 2013 to March 2014, we consummated a private placement of our securities which resulted in net proceeds to us of $1,098,900. We used $240,000 out of the net proceeds to make a payment to NMC under the Option Agreement in connection with the option grant closing and the option exercise closing. Under the Option Agreement, we undertook to provide at least $260,000 of working capital to or for the benefit of Gazania from the option grant closing date to June 30, 2014. plan on raising additional funds from investors to implement our business model. In the event we are unsuccessful, this will have a negative impact on our operations.

If the Company cannot find sources of additional financing to fund its working capital needs, the Company will be unable to obtain sufficient capital resources to operate our business. We cannot assure you that we will be able to access any financing in sufficient amounts or at all when needed. Our inability to obtain sufficient working capital funding will have an immediate material adverse effect upon our financial condition and our business.

Critical Accounting Policies

Development stage entity

The Company is considered a development stage entity, as defined in FASB ASC 915, because since inception it has not commenced operations that have resulted in significant revenue and the Company’s efforts have been devoted primarily to activities related to raising capital.

Going concern

The Company's financial statements are prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of obligations in the normal course of business. However, it has $2,450 in cash, has losses and an accumulated deficit, and a working capital deficiency. The Company does not currently have any revenue generating operations. These conditions, among others, raise substantial doubt about the ability of the Company to continue as a going concern.

In view of these matters, continuation as a going concern is dependent upon continued operations of the Company, which in turn is dependent upon the Company's ability to, meets its financial requirements, raise additional capital, and the success of its future operations. The financial statements do not include any adjustments to the amount and classification of assets and liabilities that may be necessary should the Company not continue as a going concern.

Management believes they can raise the appropriate funds needed to support their business plan and acquire an operating company with positive cash flow. Management intends to seek new capital from owners and related parties to provide needed funds.

Off-Balance Sheet Arrangements

We do not have off-balance sheet arrangements, financings, or other relationships with unconsolidated entities or other persons, also known as "special purpose entities" (SPEs).

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The Company's consolidated audited financial statements for the fiscal years ended December 31, 2013 and 2012, together with the report of the independent certified public accounting firm thereon and the notes thereto, are presented beginning at page F-1.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

We changed our independent registered public accounting firm effective December 5, 2013 from LBB & Associates Ltd., LLP (“LBB”) to Anton & Chia LLP. Information regarding the change in the independent registered public accounting firm was disclosed in our Current Report on Form 8-K filed with the SEC on December 11, 2013. There were no disagreements with LBB or any reportable events requiring disclosure under Item 304(b) of Regulation S-K.

ITEM 9A. CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

The Securities and Exchange Commission defines the term “disclosure controls and procedures” to mean controls and other procedures of an issuer that are designed to ensure that information required to be disclosed in the reports that it files or submits under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported, within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Securities Exchange Act of 1934 is accumulated and communicated to the issuer’s management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure. The Company maintains such a system of controls and procedures in an effort to ensure that all information which it is required to disclose in the reports it files under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified under the SEC's rules and forms and that information required to be disclosed is accumulated and communicated to principal executive and principal financial officers to allow timely decisions regarding disclosure.

As of the end of the period covered by this report, we carried out an evaluation, under the supervision and with the participation of our chief executive officer and chief financial officer, of the effectiveness of the design and operation of our disclosure controls and procedures. Based on this evaluation, our chief executive officer and chief financial officer concluded that our disclosure controls and procedures were not effective as of the end of the period covered by this report.

Management’s Annual Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting as defined in Rules 13a-15(f) and 15d-15(f) under the Securities Exchange Act. Our internal control over financial reporting is designed to provide reasonable assurance regarding the (i) effectiveness and efficiency of operations, (ii) reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles, and (iii) compliance with applicable laws and regulations.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies and procedures may deteriorate.

Management assessed the effectiveness of our internal control over financial reporting as of the end of the period covered by this report. In making this assessment, we used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control - Integrated Framework. Based on our assessment, we determined that, as of the end of the period covered by this report, our internal control over financial reporting was not effective based on those criteria.

During our assessment of the effectiveness of internal control over financial reporting as of the end of the period covered by this report, management identified the following material weaknesses:

|

1.

|

Lack of Internal Audit Function – We lack qualified resources to perform the internal audit functions properly as well as oversight of recording and reporting of information. In addition, the scope and effectiveness of the internal audit function are yet to be developed.

|

| |

|

|

2.

|

Review of Financial Information and Financial Reporting – We do not have adequate levels of review of financial information necessary to ascertain the accounting for complex transactions as well as review of financial information presented.

|

| |

|

|

3.

|

Lack of Segregation of Duties – We do not have segregation of duties between recording, authorizing and testing.

|

Remediation Initiative

We are developing a plan to ensure that all information will be recorded, processed, summarized and reported accurately, and as of the date of this report, we have taken the following steps to address the above-referenced material weakness in our internal control over financial reporting:

|

1.

|

We will continue to educate our management personnel to increase its ability to comply with the disclosure requirements and financial reporting controls; and

|

| |

|

|

2.

|

We will increase management oversight of accounting and reporting functions in the future; and

|

| |

|

|

3.

|

As soon as we can raise sufficient capital or our operations generate sufficient cash flow, we will hire additional personnel to handle our accounting and reporting functions.

|

While the first two steps of our remediation process are ongoing, we do not expect to remediate the weaknesses in our internal controls over financial reporting until the time when we start to commercialize our products (and, therefore, may have sufficient cash flow for hiring sufficient personnel to handle our accounting and reporting functions).

A material weakness (within the meaning of PCAOB Auditing Standard No. 5) is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. A significant deficiency is a deficiency, or a combination of deficiencies, in internal control over financial reporting that is less severe than a material weakness, yet important enough to merit attention by those responsible for oversight of the company's financial reporting.

This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm because as a smaller reporting company we are not subject to Section 404(b) of the Sarbanes-Oxley Act of 2002.

Changes in Internal Controls over Financial Reporting

No change in our system of internal control over financial reporting occurred during the fourth quarter of the fiscal year ended December 31, 2013 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

ITEM 9B. OTHER INFORMATION

As previously reported in the Current Report on Form 8-K filed by the Company with the SEC on March 20, 2014, on March 14, 2014, the Company exercised its option under the Option Agreement with NMC and completed its acquisition of 90% of the outstanding shares of Gazania which currently holds the License to the Aukum Graphite Mine.

As a result of the option exercise and acquisition of Gazania, the Company ceased to be a shell company as such term is defined in Rule 12b-2 under the Exchange Act.

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

The following table sets forth certain information as of March 31, 2014 concerning our directors and executive officers:

|

Name

|

|

Age

|

|

Position

|

| |

|

|

|

|

|

Michael Doron

|

|

52

|

|

Chairman, Director and Secretary

|

| |

|

|

|

|

|

Charles Bream

|

|

69

|

|

Director, Chief Executive Officer, Chief Financial Officer and Treasurer

|

Michael Doron, age 52, is an accomplished corporate leader with executive level experience in the financing of small to mid-cap private and public companies. Currently based in Stockholm, Sweden, he is also Managing Partner at DDR & Associates, a business development firm specializing in pre-IPO companies. Previously Mr. Doron was Co-Founder and a Partner in Evolution Capital, a private firm working in conjunction with DDR, and specializing in providing capital to publicly held companies using various debt instruments. He serves on the Board of Directors of MusclePharm Corp (NASDAQ: MSLP), and Great East Energy, Inc. (OTCQB: GASE). We believe that Mr. Doron’s qualifications and his extensive experience with emerging public companies provide a unique perspective for our board.

Charles Bream, age 69, is a seasoned executive, turnaround expert, and investor with over 30 years experience leading companies in the telecommunications, computer, office products, and packaged goods sectors. He has managed public and private companies as president/CEO, has served as a senior executive at Fortune 500 corporations, and has worked in environments ranging in revenue from $1 million to over $15 billion. Mr. Bream was appointed President and CEO of Next Graphite, Inc. in October 2013. He is also Managing Partner of an M&A and merchant banking firm which he co-founded. Prior to this he served as Senior Managing Director at a national specialty financial advisory services firm, and as Senior Managing Director at a turnaround and restructuring firm. Mr. Bream holds a B.S. in Electrical Engineering from the United States Naval Academy and earned an MBA from the Wharton School of Business, University of Pennsylvania. We believe that Mr. Bream’s qualifications and his extensive business experience position him well as our director.

Our directors hold their positions on the board until our next annual meeting of the shareholders, and until their successors have been qualified after being elected or appointed. Officers serve at the discretion of the board of directors.

There are no family relationships among our directors and executive officers. There is no arrangement or understanding between or among our executive officers and directors pursuant to which any director or officer was or is to be selected as a director or officer, and there is no arrangement, plan or understanding as to whether non-management shareholders will exercise their voting rights to continue to elect the current board of directors.

Our directors and executive officers have not, during the past ten years:

| |

●

|

had any bankruptcy petition filed by or against any business of which was a general partner or executive officer, either at the time of the bankruptcy or within two years prior to that time,

|

| |

●

|

been convicted in a criminal proceeding and is not subject to a pending criminal proceeding,

|

| |

●

|

been subject to any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities, futures, commodities or banking activities; or

|

| |

●

|

been found by a court of competent jurisdiction (in a civil action), the Securities Exchange Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacate

|

Board Committees

We currently do not have standing audit, nominating or compensation committees. Currently, our entire board of directors is responsible for the functions that would otherwise be handled by these committees. We intend, however, to establish an audit committee, a nominating committee and a compensation committee of the board of directors as soon as practicable. We envision that the audit committee will be primarily responsible for reviewing the services performed by our independent auditors, evaluating our accounting policies and our system of internal controls. The nominating committee would be primarily responsible for nominating directors and setting policies and procedures for the nomination of directors. The nominating committee would also be responsible for overseeing the creation and implementation of our corporate governance policies and procedures. The compensation committee will be primarily responsible for reviewing and approving our salary and benefit policies (including stock options), including compensation of executive officers.

Audit Committee Financial Expert

The Board of Directors does not currently have Audit Committee financial expert, as defined under Item 407(d)(5)(i) of Regulation S-K.

Code of Ethics

We do not have a code of ethics but intend to adopt one in the near future.

Board Leadership Structure

Charles Bream is our Chief Executive Officer. Michael Doron is the Chairman of our Board of Directors. We believe a board leadership structure involving one person serving as chairman and another as chief executive officer is best for our company and our stockholders. Further, we believe this separation improves the Board’s oversight of management, provides greater accountability of management to stockholders, and allows the chief executive officer to focus on managing our business operations, while allowing the chairman to focus on more effectively leading the Board and overseeing our general strategic direction and extraordinary transactions.

Potential Conflict of Interest

Since we do not have an audit or compensation committee comprised of independent Directors, the functions that would have been performed by such committees are performed by our Board of Directors. Thus, there is a potential conflict of interest in that our Directors have the authority to determine issues concerning management compensation, in essence their own, and audit issues that may affect management decisions. We are not aware of any other conflicts of interest with any of our executives or Directors.

Board’s Role in Risk Oversight

The Board assesses on an ongoing basis the risks faced by the Company. These risks include financial, technological, competitive, and operational risks. The Board dedicates time at each of its meetings to review and consider the relevant risks faced by the Company at that time. In addition, since the Company does not have an Audit Committee, the Board is also responsible for the assessment and oversight of the Company’s financial risk exposures.

ITEM 11. EXECUTIVE COMPENSATION

The following is a summary of the compensation we paid to our executive officers, for the two fiscal years ended December 31, 2013 and 2012.

Summary Compensation Table

|

Name and Position

|

|

Year

|

|

Salary

($)

|

|

|

Stock

Awards

($)

|

|

|

Total

($)

|

|

|

Charles Bream(1)

|

|

2013

|

|

|

6,000

|

|

|

|

300,004

|

|

|

|

306,004

|

|

|

CEO, CFO and Director of the Company

|

|

2012

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michael Doron(2)

|

|

2013

|

|

|

2,000 |

|

|

|

100,012

|

|

|

|

102,012

|

|

|

Chairman and Director of the Company

|

|

2012

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mohsin Mulla(3)

|

|

2013

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

CEO, CFO and Director

|

|

2012

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

(1)

|

Mr. Bream was appointed as the Chief Executive Officer, Chief Financial Officer and Director of the Company on November 14, 2013.

|

| |

|

|

(2)

|

Mr. Doron was appointed as our Chairman and Director of the Company on November 14, 2013.

|

| |

|

|

(3)

|

Mr. Mulla resigned as our Chief Executive Officer, Chief Financial Officer and Sole Director of the Company on November 14, 2013.

|

Compensation Discussion and Analysis

Overview

We intend to provide our named executive officers (as defined in Item 402 of Regulation S-K) with a competitive base salary that is in line with their roles and responsibilities when compared to peer companies of comparable size in similar locations.

Employment Agreements

On September 2, 2013, AGI and 360 Partners, LLC (the “Consultant”) entered into an independent consultant agreement for the service of Mr. Charles Bream, the principal of the Consultant as AGI’s Chief Executive Officer, Chief Financial Officer, Director and Treasurer for a term of six months. On November 14, 2013 he was appointed to the same positions at the Company. The agreement is automatically renewable for additional six months unless either party notifies the other at least 30 days prior to the end of the term of an intention to terminate. Under the agreement, the Consultant is compensated with a monthly cash compensation of US$3,000, payable in arrears. The Consultant also received 38,462 shares of AGI’s common stock that were exchanged for approximately 300,004 shares of the Company’s common stock on November 14, 2103, which are not subject to any vesting conditions or subject to forfeiture.

On September 27, 2013 AGI and Michael Doron entered into an independent consultant agreement as AGI’s Chairman and Director for a term of six months. On November 14, 2013 he was appointed to the same positions at the Company. The agreement is automatically renewable for additional six months unless either party notifies the other at least 30 days prior to the end of the term of an intention to terminate. Under the agreement, Mr. Doron is compensated with a monthly cash compensation of US$1,000, payable in arrears. Mr. Doron also received 12,821 shares of AGI’s common stock that were exchanged for approximately 100,012 shares of the Company’s common stock on November 14, 2103, which are not subject to any vesting conditions or subject to forfeiture.

Outstanding Equity Awards at Fiscal Year End

None.

Additional Narrative Disclosure

We have no plans that provide for the payment of retirement benefits, or benefits that will be paid primarily following retirement, including, but not limited to, tax qualified defined benefit plans, supplemental executive retirement plans, tax qualified defined contribution plans and non-qualified defined contribution plans.

Director Compensation

The following table reflects the compensation of the directors (other than the named executive officers) including director fees and consulting fees for the Company’s fiscal year ended December 31, 2013:

|

Name of Director

|

|

Fees Earned or

Paid in Cash

($)

|

|

|

Stock

Awards

($)(1)

|

|

|

Total

($)

|

|

|

Charles Bream

|

|

$ |

6,000

|

|

|

|

300,004

|

|

|

|

306,004

|

|

|

Michael Doron

|

|

|

2,000

|

|

|

|

100,012

|

|

|

|

102,012 |

|

|

(1)

|

The amounts in these columns represent the compensation cost of stock awards granted during the fiscal year ended December 31, 2013, except that these amounts do not include any estimate of forfeitures. The amount recognized for these awards was calculated based on the value of the stock awards at the time of vesting.

|

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth information regarding beneficial ownership of our common stock as of the date of this report by (i) any person or group with more than 5% of any class of voting securities, (ii) each director, (iii) our chief executive officer and each other executive officer whose cash compensation for the most recent fiscal year exceeded $100,000, and (iv) all such executive officers and directors as a group. Unless otherwise specified, the address of each of the officers and directors set forth below is in care of the Company, 318 N. Carson Street, Suite 208, Carson City, NV 89701. Except as indicated in the footnotes to this table and subject to applicable community property laws, the persons named in the table to our knowledge have sole voting and investment power with respect to all shares of securities shown as beneficially owned by them.

|

Name

|

|

Office

|

|

Shares

Beneficially

Owned(1)

|

|

|

Percent of

Class(2)

|

|

| |

|

|

|

|

|

|

|

|

|

Officers and Directors

|

|

|

|

|

|

|

|

|

|

Michael Doron

|

|

Chairman, Director and Secretary

|

|

|

100,012

|

|

|

|

*

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Charles Bream(3)

|

|

Director, CEO, CFO and Treasurer

|

|

|

300,004

|

|

|

|

*

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

All officers and directors as a group (2 persons named above)

|

|

|

|

|

400,016

|

|

|

|

*

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

5% Securities Holders

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

NMC Corp.(4)

148 Yorkville

Toronto, Ontario

M5R 1C2

Canada

|

|

|

|

|

12,600,003

|

|

|

|

25.49

|

%

|

|

*

|

Less than 1%.

|

| |

|

|

(1)

|

Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities.

|

| |

|

|

(2)

|

Based on 49,431,443 shares of the Company’s common stock outstanding.

|

|

(3)

|

Includes shares held by 360 Partners, LLC, an entity controlled by Charles Bream.

|

|

(4)

|

Ms. Vicki Rosenthal and Mr. David Deslauriers have shared voting and dispositive power over the shares held by NMC Corp.

|

Change in Control

As of the date of this report, there were no arrangements which may result in a change in control of the Company.

Securities Authorized for Issuance under Equity Compensation Plan

None.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

Transactions with related persons

On September 26, 2012, we issued an aggregate of 3,000,000 pre-split shares of our common stock to our sole officer and director, Mr. Mohsin Mulla, for a purchase price of $0.005 per share for aggregate consideration of $15,000. On November 1, 2013, we issued 300,000 pre-split shares of our common stock to Mr. Mulla for aggregate consideration of $300.

On November 14, 2013, Mr. Mulla and AGI entered into and consummated transactions pursuant to a Stock Purchase Agreement whereby Mr. Mulla sold to AGI for $76,000 all 3,300,000 of his pre-split shares of the Company’s common stock representing approximately 50.8% of the then issued and outstanding shares of common stock.

On November 14, 2013, the Company issued 12,600,003 shares of its common stock to NMC in connection with the option grant under the Option Agreement.

On March 26, 2014 the Company cancelled the 3,300,000 pre-split shares of the Company’s stock acquired under the Stock Purchase Agreement with Mr. Mulla, resulting in the current 49,431,443 shares of the Company’s common stock outstanding.

Other than the above transactions or as otherwise set forth in this report or in any reports filed by the Company with the SEC, there have been no related party transactions, or any other transactions or relationships required to be disclosed pursuant to Item 404 of Regulation S-K. The Company is currently not a subsidiary of any company.

The Company’s Board conducts an appropriate review of and oversees all related party transactions on a continuing basis and reviews potential conflict of interest situations where appropriate. The Board has not adopted formal standards to apply when it reviews, approves or ratifies any related party transaction. However, the Board believes that the related party transactions are fair and reasonable to the Company and on terms comparable to those reasonably expected to be agreed to with independent third parties for the same goods and/or services at the time they are authorized by the Board.

Director Independence